June 24, 2015

Property and real estate

June 24, 2015

Potential value of older workers to UK economy

Commenting for the UK200Group, BKL tax partner David Whiscombe responds to new research suggesting that...

June 24, 2015

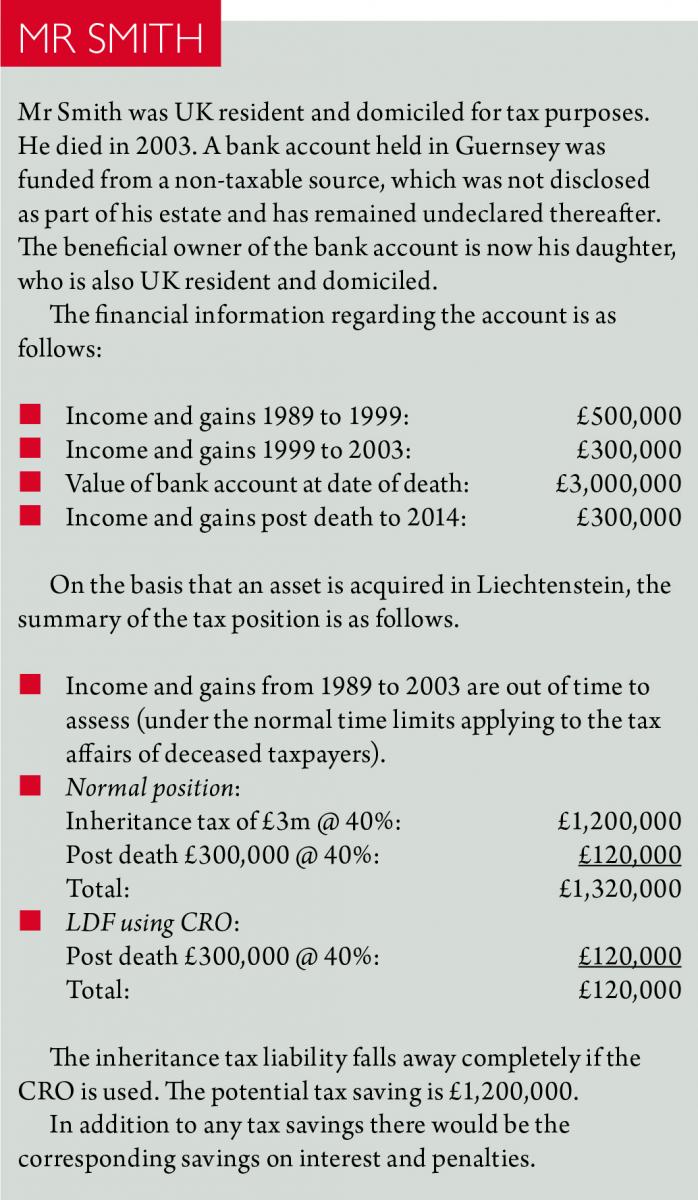

LDF: Final countdown

In an article for Taxation magazine, we examine the impact of the Liechtenstein Disclosure...

June 23, 2015

Pre-Budget action desirable?

There will be a second budget on 8 July in which it is to...

June 22, 2015

Cooling off: debt as consideration for CGT disposal

The recent First-tier Tribunal decision in Cooling [2015] UKFTT 223 (TC) is more complex...

June 17, 2015

Cashing in personal pensions

Commenting for the UK200Group, BKL tax partner David Whiscombe responds to Chancellor George Osborne’s comments...

June 17, 2015

Incorporation of buy-to-let business

Writing for Tax Journal (issue 1266), BKL tax adviser Andrew Levene answers a query...

June 17, 2015

£250m of pension pots spent on housing

‘Official figures suggest that £1bn has been transferred from people’s pensions since new rules...

June 17, 2015

HMRC and “Mid-Size Businesses”

In 2014 HMRC published the findings of some research it had carried out into...

June 10, 2015

Osborne’s plans for permanent surplus

BKL tax partner David Whiscombe comments via the UK200Group on reports that Chancellor George Osborne...

June 4, 2015

HMRC penalty ‘amnesty’

Readers may have read recently of HMRC’s change in practice on penalties for late...

June 4, 2015

Duty-bound by tax planning pitfalls

BKL tax partner David Whiscombe’s article for FT Adviser on tax avoidance and tax...